Going Green with Your Portfolio: Getting Smart or Getting Trendy?

With World Environment Day on June 5, many Aussie investors are considering whether environmentally conscious investing is a worthwhile aspect of their financial strategy. Whether

With World Environment Day on June 5, many Aussie investors are considering whether environmentally conscious investing is a worthwhile aspect of their financial strategy. Whether

Key points In contrast to last year, the major themes dominating markets in 2025 are: Slowing global economic growth as forecast by the International Monetary

“I don’t have enough assets to worry about a will.” “I’m too young to think about estate planning.” “I’ll get around to it later.” Does

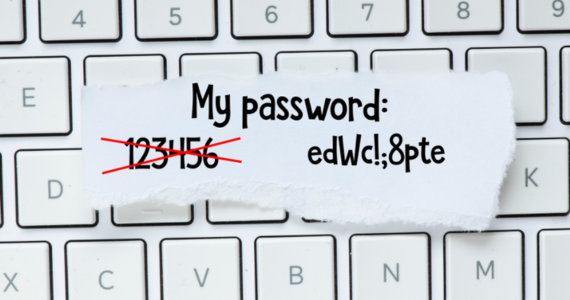

May 1 is World Password Day and serves as a timely reminder to reset your passwords regularly to help keep yourself safe online. Cybercrime can

We all want the best for our kids. Life throws many challenges at them as they grow up, and one that is becoming more and

In recent years and months, market volatility has once again tested the nerves of investors. From the post-COVID recovery to ongoing geopolitical tensions, persistent inflation,

With the financial year end approaching, now is the perfect time to consider making additional contributions to your superannuation. Despite rising living costs affecting households

Dying is not something we like to think about, however, a bit of pre-planning can save a lot of heartache for those we leave behind.

Every time you spend money, you choose your future. Will this purchase bring lasting value to your life, or is it just a fleeting desire?

Most of us suffer from this condition at some time or another. Imagine going to buy a loaf of bread. It seems simple, but once

So, you’ve had your farewell party, and your ex-colleagues have sent you on your merry way. Come Monday morning, you shouldn’t be asking yourself, “What

Roger was an auditor at a large multinational consulting firm. He was a conscientious worker, confident, capable and always positive. But Roger’s cheerful smile concealed